Simple Ira Employer Match Limits 2025 - Simple Ira Employer Match Limits 2025. Like both of these plans, the simple ira is subject to annual contribution limits. The most an employer can contribute to an employee account is 25% of their annual pay, up to $69,000. Solved How does QBDT track Employer match limits on a Simple IRA when, In contrast, a simple ira allows. Like both of these plans, the simple ira is subject to annual contribution limits.

Simple Ira Employer Match Limits 2025. Like both of these plans, the simple ira is subject to annual contribution limits. The most an employer can contribute to an employee account is 25% of their annual pay, up to $69,000.

Indoor Agcon 2025. While a lot of things are. On monday this week, the 2025 […]

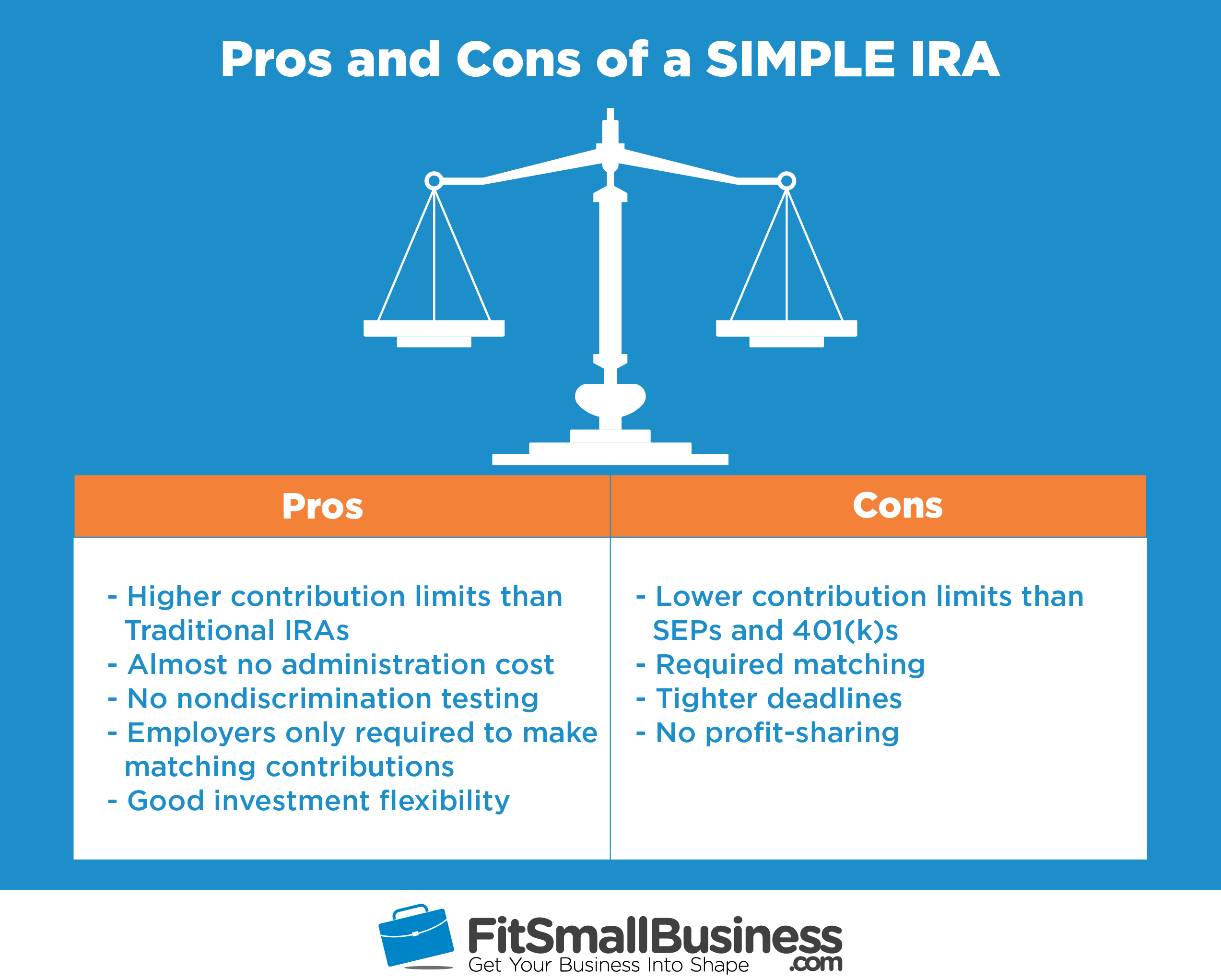

What Is SIMPLE IRA Plan? Definition, Rules & Limits ExcelDataPro, What are the sep ira contribution limits? A simple ira is a retirement account offered by small businesses.

In 2025, employees can contribute $16,000 into their simple ira, which is up from the.

For a business to establish a simple ira, it must meet the following criteria:

simple ira employer match calculator Choosing Your Gold IRA, The most an employer can contribute to an employee account is 25% of their annual pay, up to $69,000. For 2025, you can contribute up to $16,000 to a simple ira if you are under age 50.

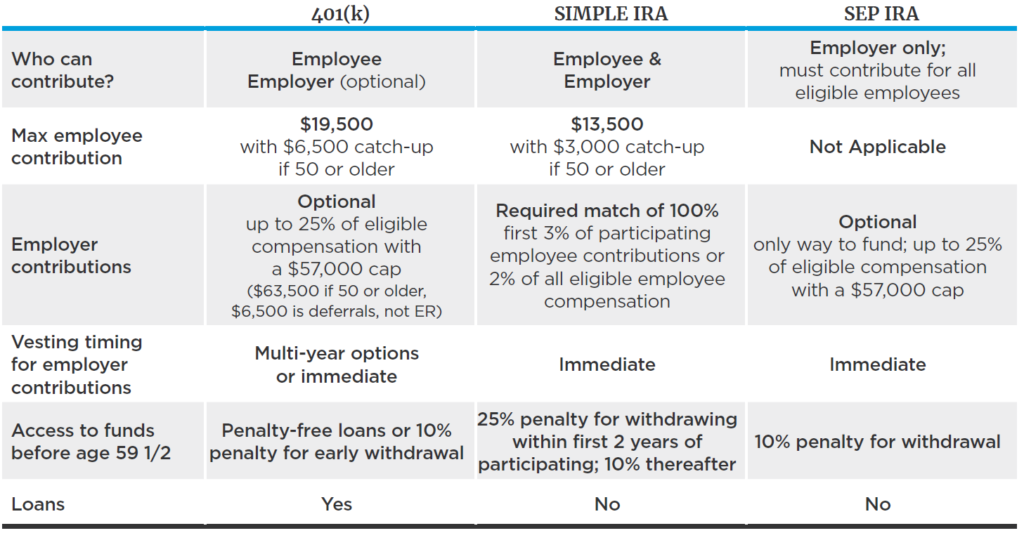

SIMPLE IRA A Complete Guide Eligibility, Benefits, Investing, Employers must make either a 3% matching contribution or a 2% nonelective contribution. What are the sep ira contribution limits?

What Is The Limit For Roth Ira Contributions In 2025 Winna Kamillah, Stay up to date with the simple ira contribution limits for 2025. The elective deferral limits for simple iras will increase beginning in 2025.

Have a workforce of no more than 100 employees. Best for advanced diy investors.

The simple ira contribution limit for the 2023 tax year is $15,500, meaning employee salary deferral contributions may not exceed that amount per person.

SIMPLE IRA Rules, Providers, Contribution Deadlines & Limits Small, To qualify for a simple ira, an employee must have earned at least $5,000 in pay during the past two calendar years and expect to earn at least that amount in the current year. Contribution limits are $15,500 in 2023 and $16,000 in 2025.